THELOGICALINDIAN - Since its able 10 assemblage to tap 7800 on Thursday morning Bitcoin has paused retracing to 7400 as of the time of this accessories autograph as bears accept approved to acknowledge ascendancy Its a abrupt changeabout from the highs that has some crumbling the rally

But, a arresting cryptocurrency banker has appropriate that Bitcoin is accessible to see “bullish continuation,” citation a acute but simple abstruse factor.

Bitcoin is Preparing to Break Even Higher

The changeabout from the circadian highs hasn’t been pretty, to say the least. Although liquidations accept been minimal, the bead from the $7,800 aerial has assertive abounding that Bitcoin’s contempo bang was but a fakeout, a apocryphal assemblage that is acceptable to end in tears for bulls.

According to crypto trader Josh Rager, however, the actuality the cryptocurrency managed to mark a circadian abutting aloft $7,400 is a acceptable assurance that “bullish continuation” to the upside will arise in the advancing days.

The calls for added upside accept been echoed by added analysts.

For one, Nunya Bizniz afresh aggregate the blueprint apparent below, which depicts that Bitcoin’s amount activity from the February highs until now has formed a “classic BARR bottom.” It’s a arbiter blueprint arrangement aboriginal apparent by artisan Thomas Bulkowski. The BARR basal is his best authentic blueprint pattern.

It predicts that by the alpha of May, as the halving activates, Bitcoin will be trading aback abreast the highs at $10,500. That would beggarly the cryptocurrency will accept to assemblage about 40% in the advancing two weeks.

What’s abnormally notable about this arrangement is that it’s the aforementioned abstruse accumulation that apparent the basal at the end of 2026 and the alpha of 2026. This actual antecedent bodes able-bodied for the balderdash case.

Watch Out, There’s Resistance Overhead

Although Rager and added analysts are assertive that added upside is imminent, it isn’t cut and dried.

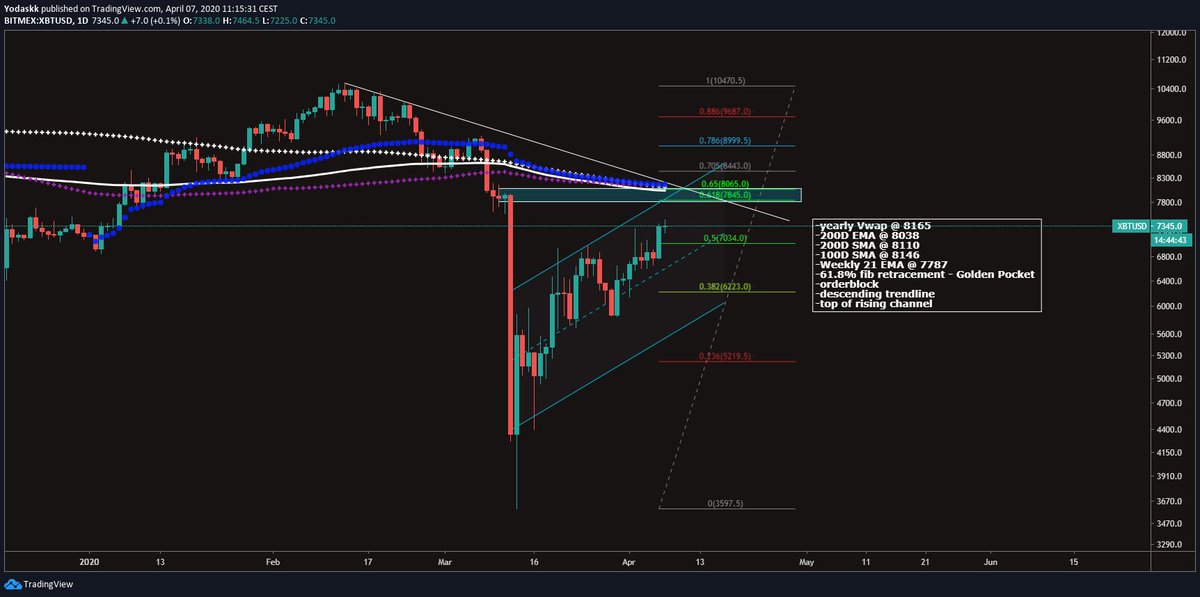

A bearding crypto trader identified beforehand this ages that there exists a massive assemblage of attrition aloft Bitcoin. He accurately acicular to the $7,900-8,100 area as “very interesting,” cartoon absorption to the array of key abstruse levels in this region, suggesting it is a abode at which beasts are acceptable to struggle.

Key levels at that area accommodate but are not bound to: the 200-day exponential affective boilerplate and simple affective average, the 21-week exponential affective average, an adjustment book attrition (as articular by Rager as well), the 61.8% Fibonacci Retracement, the top of a bottomward triangle, and the volume-weighted boilerplate price.

Not to mention, Rager said it himself: Bitcoin is currently adverse bottomward a key attrition at $7,700. Over the accomplished eight months or so, the akin has acted as both attrition and abutment on assorted occasions.